THE OPENER-

...an extremely reliable intraday crude oil trading strategy.

THE OPENER is an extremely reliable and consistent intraday crude oil futures trading strategy.

The market makers in the crude oil market have been around for a long time, and have developed a reliable pattern based on the orders of large players. This strategy only utilizes time and price is these pattern formations.

This crude oil trading strategy only enters and exits within the old pit times for US session. Having an overnight desk is unnecessary.

Performance

THE OPENER minimizes trade number and market exposure, while maintaining consistent results. A consistently high benchmark over time without a monthly drawdown characterizes this little beauty. See below for Version 2 of the strategy stats.

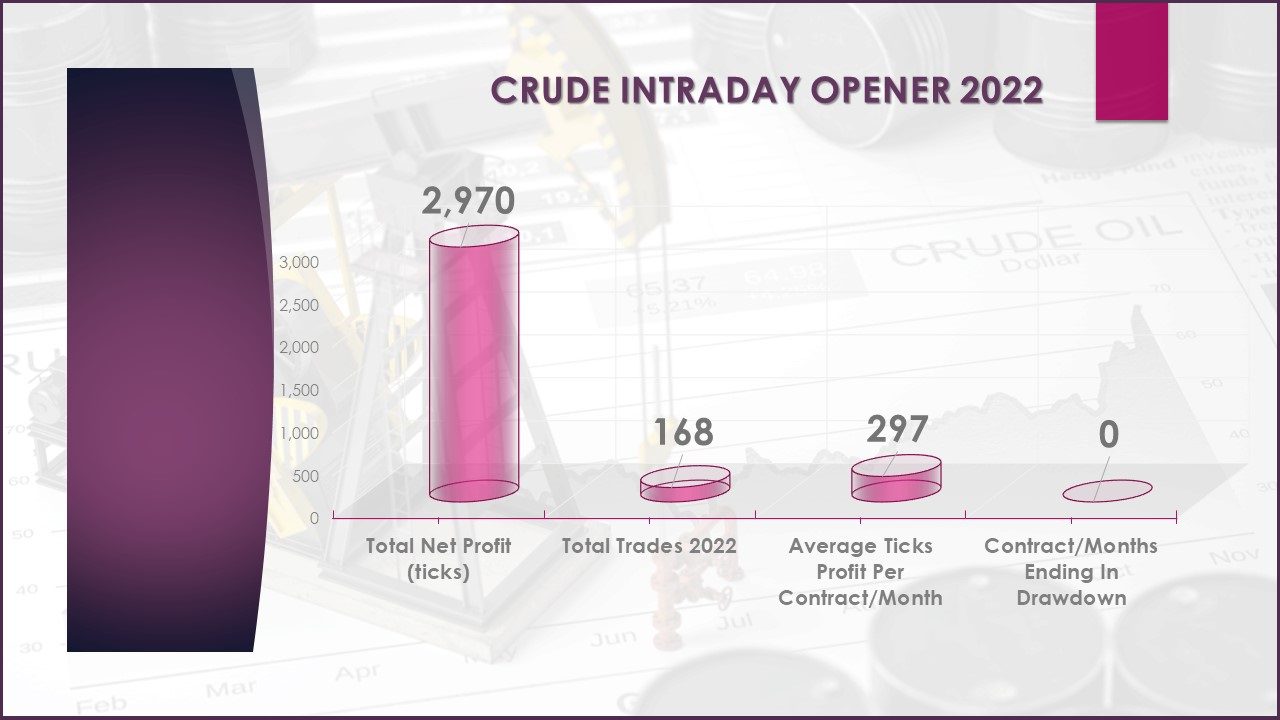

The OPENER has you out and flat by the end of each day, and trades begin after the old Pit time of 9am EST. See below for net ticks up for 2022. Taking a monthly unit of return, we found no drawdowns for 2022.

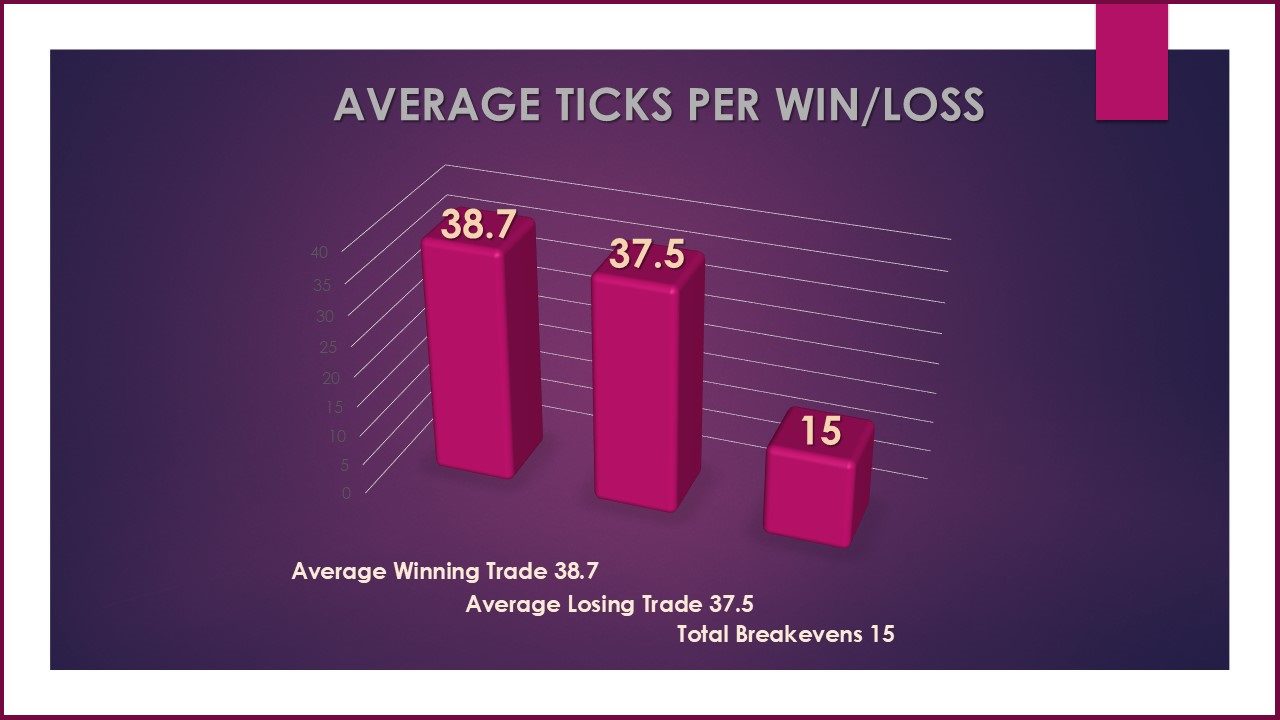

Below are the average number of ticks per winning trade, losing trade, and number of breakeven trades.

Futures, Equities, and Options trading/investing has large potential rewards, but also large potential risk and is not suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in the equities, futures and options markets. Do not trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown on this website. The past back-testing performance of any trading method, strategy, or technical analysis technique, strategy or methodology is not necessarily indicative of future results. No one associated with RGS or this website are Registered Investment Advisors, Commodity Trading Advisors, or certified, registered, affiliated or approved in in any way with either the National Futures Association, Securities and Exchange Commission, Commodities Futures Trading Commission, or any other organization.

Recipients of market strategies, indicators, and other market solutions from RGS receive hypothetical, back–tested data and not actual trade results. Technical analysis, indicators, strategies, and market solutions, including any descriptions or evaluations of their performance, included in this training and displayed on this website, are described and evaluated based on hypothetical back-testing, and not the actual trades or earnings of any individual or entity. The many strategies and techniques represented on this website include far more applications to market instruments and time frames than the presenter can possibly implement. Author & presenter has sources of income in addition to work with financial markets. In any and all descriptions displayed on this website, no individual or entity, including past clients or presenter, “hold themselves out” as achieving any level of success trading, investing, or amassing any level of wealth or income derived from any or all of the strategies, techniques, information, or market solutions offered on this website.

Nothing displayed on this website or offered in any training on this website constitutes a “futures trading system” or a “stock trading system.” Nothing shown or described on this website should be taken as any individual or entity claiming, inferring, or insinuating, investment advice in any way. No one associated with any training or information on this website accurately verifies or tracks results of past clients.

CFTC RULE 4.41

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Your results may differ from back-testing statistics. Intraday market strategies comprise part of our market strategy portfolio. This does not mean we recommend them, or “day trading” to everyone. Intraday trading requires a higher degree of accuracy, platform, consistency, capital, and discipline to use profitably. In a 2014 UC paper that studied 3.7 billion TSE trades from 1992-2006, only 3% of “day traders” profited on an average day. On August 19, 2019 the San Paolo School of Economics published a study tracking at 1,551 retail traders for at least 300 short-term futures trades in iBovespa contracts. They found only 1.1% posted higher average net returns than the Brazilian minimum wage over a year. Though we lack studies of a comparable scope on US traders on US markets, we estimate the % of profitable retail intraday traders to be under 8%.