Rapid Addition’s product suite offers an end-to-end middleware solution that enables seamless trading ecosystem interoperability and simplifies electronic trading workflow creation and deployment. By unifying these fragmented systems, your trading desk is able to achieve unparalleled transparency and control. “But that sounds like an oversimplified generic solution for retail traders, right?” Wrong…

Citi integrated the RA FIX Engine and RA Hub platform into its pricing technology for spot FOREX transactions. This helped Citi scale its eFX pricing distribution to serve a multi-region client base, managing extremely high transaction volumes with consistent reliability while achieving market-leading latency. This approach vastly improved pricing quality, strengthening market share, and boosting profitability. We are pleased to announce that all Rapid Addition products are available to trading desks of all sizes in the Chicagoland area and beyond.

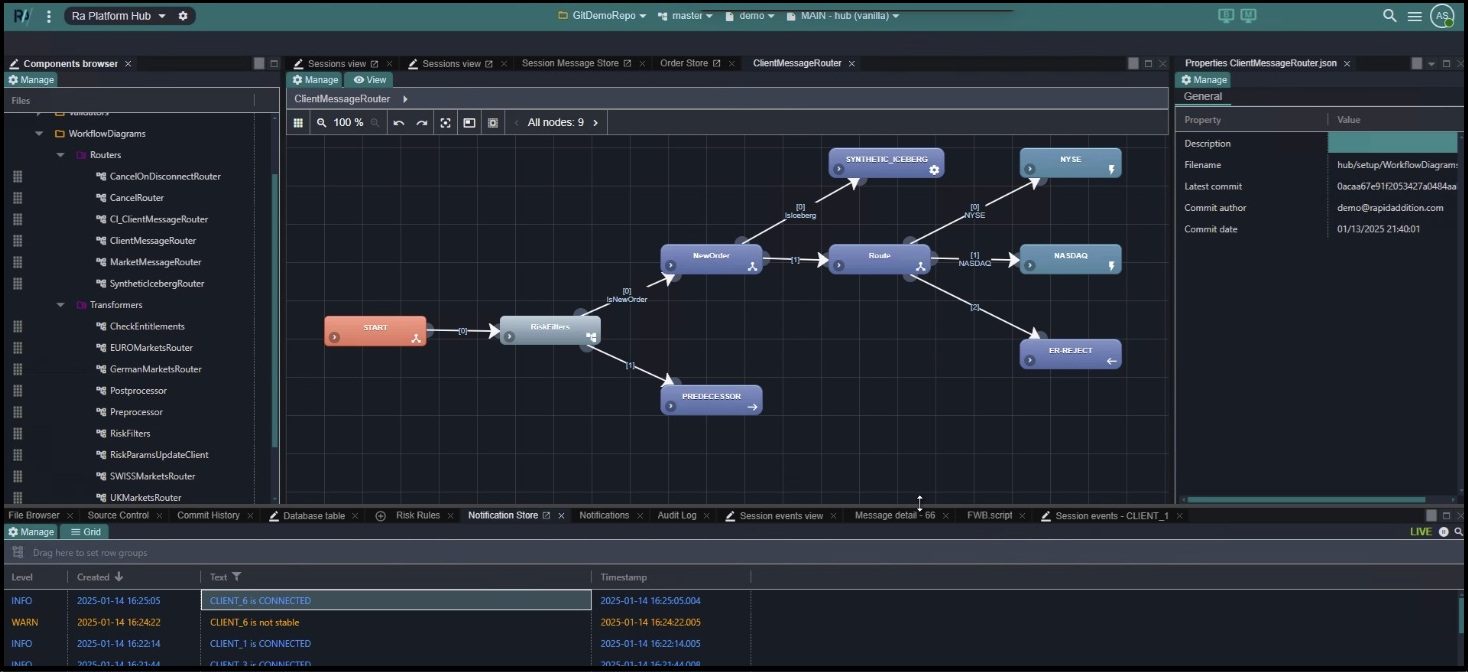

Within one platform, you can outline custom electronic trading workflows in an innovative, easy-to-use drag and drop editing module.

OMS/EMS integration, risk check, regulation compliance, reporting, exchange routing, ATS selection, and data sharing can all be easily configured. You can deploy your custom logic via spanning trees branching out at any point in the chain. You can also insert trading, money management, and routing algorithms into the chain via JavaScript modules. Complex order types can easily be accommodated. Want to change it? Log in, then drag and drop.

Want to change the order flow exchange routing? Log in, then drag and drop.

Once you've arranged your trade flow, the internal messages in the Rapid Addition platform are then reconverted to FIX (or a variety of protocol options) and sent out to exchanges, ATS and analytics. Here's the trick – proprietary acceleration actually lowers your latency in this process.

Call us today at 630-486-0466 or email us at Fintech@consultrgs.net to schedule a free consultation.

KEY FEATURES OF RAPID ADDITION

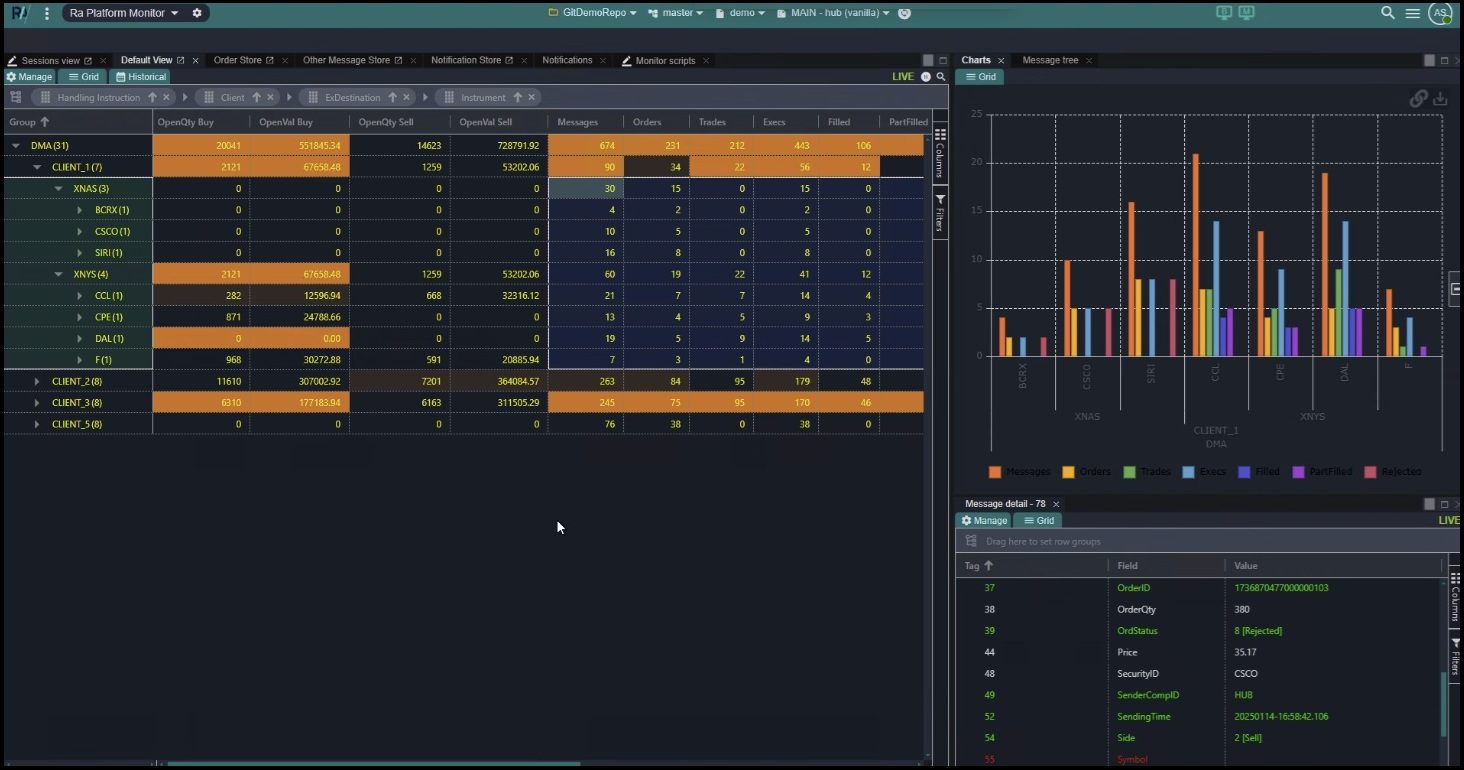

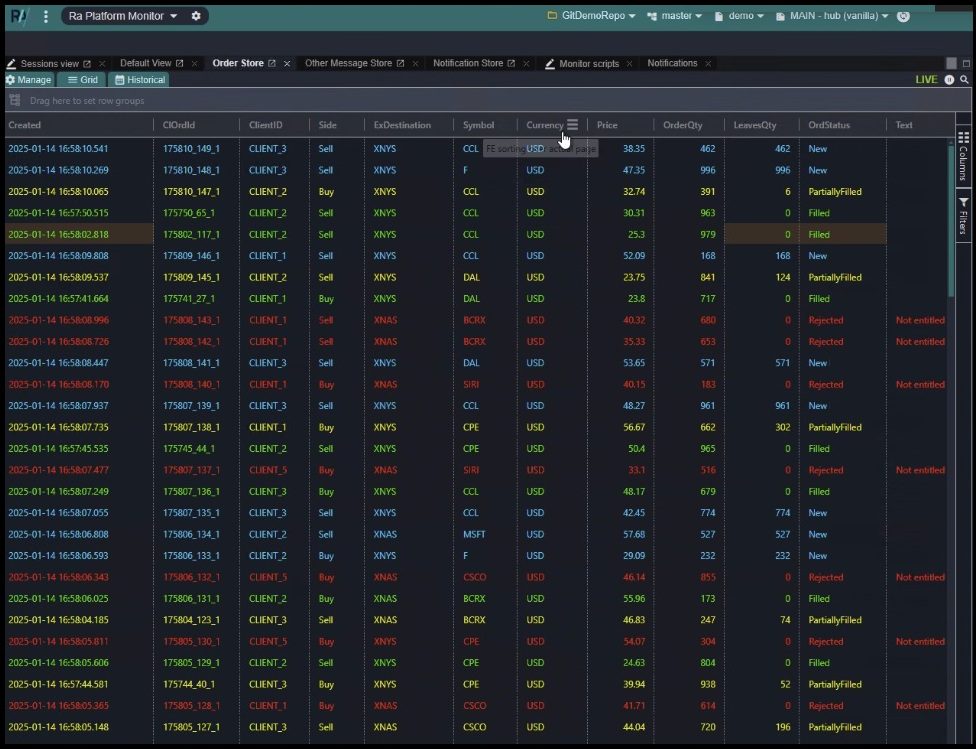

Monitor everything on your trading desk on one dashboard, equipped with real-time order and session status, advanced alerting, message tracing, and log files. Through their partnership with ipushpull – a leading provider of live data sharing and workflow automation solutions – Rapid Addition solves the problem of missing alerts and enables seamless data sharing with apps like MS Excel, MS Teams, Symphony, among others.

Want to scale? Rapid Addition’s solutions can be deployed globally, maintaining compliance with regulations such as DORA and MiFID II. Rapid Addition’s open development framework allows you to add new counterparties instantly along with their proprietary routing rules, FIX version, or trading rules. RA Platform is vendor and technology agnostic and works with all asset classes and trading models. It can be deployed on premise, via cloud or using a hybrid model.

Getting granular with the tech, you can break down silos and unify data from different APIs, protocols and formats. In terms of redundancy, you have built-in disaster recovery, failover, and slow-consumer mechanisms for uninterrupted service. Advanced memory management and deterministic CPU behavior provide unmatched performance, even under peak loads.

Besides the ease of seamless integration, Rapid Addition allows you to instantly adapt to changing markets and client demands without worrying about hang-ups in your trading desk.

Rapid Addition also has a world-class support team, covering all time zones, which follows ITIL best practices to provide comprehensive service delivery, including incident management, ticket resolution, troubleshooting, and access to technical documentation. Auto-testing and replay make complex migrations a snap. Their team of experienced financial industry technical consultants provides valuable services to support deployment and enhancements to your RA Platform.

They can assist with solution design, analyzing user requirements, developing POC, migration, building adapters, and customized functionality and integration with your existing trading stack.

BUY OR SELL SIDE

Sell Side

On the sell side, win and retain clients. Rapid Addition’s protocol and asset class agnostic platform translates any messaging format, making configuration and conformance testing easy and slashing the time to onboard new clients. Risk filters need to be highly performant, implementing critical checks without adding latency. Rapid Addition combines the speed of optimized software or FPGA with software flexibility, catering for the broadest range of client types and trading strategies, while meeting the most exacting performance benchmarks. Quickly deploy your business rules and update them intraday for ultimate levels of client responsiveness.

Sell-side trading firms face intense scrutiny and severe penalties for breaches of behavior and conduct rules. Rapid Addition helps you mitigate such risks by giving customers a forensic view of real-time order flow through their Web UI, validating order logic behavior and helping to identify breaches, disorderly trading and market abuse.

Buy Side

On the buy side, Rapid Addition’s platform can support use cases such as ensuring seamless data flow between multiple Order or Execution Management Systems and post-trade systems such as risk management and trade reporting. Removing the need for hard integration between applications gives you automation efficiencies and also makes it easier to upgrade or replace components in your trading value-chain. Ultimately this automates and simplifies workflow and leads to lower operational costs.

Call us today for a free consultation.